I. Interbank bond index series

On 10 June 2002, the National Interbank Funding Center (hereinafter referred to as CFETS) launched the interbank bond index series. On 29 June 2009, in order to coordinate the new generation RMB system online, CFETS launched the new version of the interbank bond index series which includes a treasury bond index, a short-term treasury bond index, a medium-term treasury bond index, a long-term treasury bond index, a policy financial bond index, a composite bond index, a corporate bond index and a medium-term note index, all of which comprise full price and net price indices.

|

Type of Index |

Maturity (Years) |

Initial Date |

Bond Sample |

|

Treasury Bond Index |

(1,30] |

June 10, 2002 |

Book-entry Treasury Bonds |

|

Short-term Treasury Bond Index |

(1,3] |

June 10, 2002 |

Book-entry Treasury Bonds |

|

Medium-term Treasury Bond Index |

(3,7] |

June 10, 2002 |

Book-entry Treasury Bonds |

|

Long-term Treasury Bond Index |

(7,30] |

June 10, 2002 |

Book-entry Treasury Bonds |

|

Policy Financial Bond Index |

(1,30] |

June 10, 2002 |

Policy Financial Bonds |

|

Composite Bond Index |

(1,30] |

January 4, 2007 |

Book-entry Treasury Bonds, Policy Financial Bonds, Corporate Bonds and Medium-term Notes |

|

Corporate Bond Index |

(1,30] |

January 4, 2007 |

Corporate Bonds |

|

Medium-term Note Index |

(1,30] |

May 4, 2008 |

Medium-term Notes |

II. Pricing rules

Purpose of compilation: in order to offer real-time, comprehensive information reflecting the overall operating status of the bond market or a certain type of bond in the interbank bond market.

Purpose of compilation: in order to offer real-time, comprehensive information reflecting the overall operating status of the bond market or a certain type of bond in the interbank bond market.

Initial index points: 1,000 points

Initial index points: 1,000 points

Types of indices: full price index and net price index

Types of indices: full price index and net price index

Bond types: fixed rate bonds, zero coupon bonds and discount bonds

Bond types: fixed rate bonds, zero coupon bonds and discount bonds

Options types: option-free bond

Options types: option-free bond

Frequency of updates: the opening index is calculated at 9:00 on every workday and updated every five minutes until closing at 16:30.

Frequency of updates: the opening index is calculated at 9:00 on every workday and updated every five minutes until closing at 16:30.

Pricing sources: market-making quotations, one-click quotations, cash bond deal prices and bond valuations in the interbank bond market

Pricing sources: market-making quotations, one-click quotations, cash bond deal prices and bond valuations in the interbank bond market

Order of priority for prices: deal price, mean price of one-click quotation, and bond valuations

Order of priority for prices: deal price, mean price of one-click quotation, and bond valuations

Weighting of sample bonds: market capitalization in the interbank market

Weighting of sample bonds: market capitalization in the interbank market

Frequency of sample adjustments: samples are adjusted at the end of every month

Frequency of sample adjustments: samples are adjusted at the end of every month

Sampling rules for new bonds: after the new bond is listed and goes into circulation, the new bond is incorporated into the index sample after market closing on the first day on which effective market-making prices, click prices or deal prices exist.

Sampling rules for new bonds: after the new bond is listed and goes into circulation, the new bond is incorporated into the index sample after market closing on the first day on which effective market-making prices, click prices or deal prices exist.

Rules for discarding abnormal prices: according to historical volatility in net bond prices over the 60 preceding trading days, the normal range of net price volatility for the next trading day is determined in light of the established confidence level, and net prices outside this range are deemed to be abnormal prices; abnormal price assessments are made throughout the whole bond index calculation process, including for the opening index, the intraday index and the closing index.

Rules for discarding abnormal prices: according to historical volatility in net bond prices over the 60 preceding trading days, the normal range of net price volatility for the next trading day is determined in light of the established confidence level, and net prices outside this range are deemed to be abnormal prices; abnormal price assessments are made throughout the whole bond index calculation process, including for the opening index, the intraday index and the closing index.

III. Calculation method

(1) Calculation formula

Aggregate market value method (Passche Weighted Index):

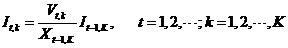

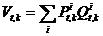

is the market value at publication time point k on trading day t for the index sample, that is,

is the market value at publication time point k on trading day t for the index sample, that is,  .

.  and

and  are the price and turnover chosen for bond i in the index sample at publication time point k, respectively;

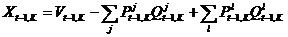

are the price and turnover chosen for bond i in the index sample at publication time point k, respectively;  is the market value after calculating the closing index and adjusting the index sample for the previous trading day (t-1 period), for which the algebraic expression is as follows

is the market value after calculating the closing index and adjusting the index sample for the previous trading day (t-1 period), for which the algebraic expression is as follows Bonds denoted by j are discarded after the close of the t-1 period and bonds denoted by I are included after the close of the t-1 period.

Bonds denoted by j are discarded after the close of the t-1 period and bonds denoted by I are included after the close of the t-1 period.

(2) Adjustment for dividend

If there is a dividend in the current month, the amount of interest paid is deducted from ![]() after closing on the last trading day of that month.

after closing on the last trading day of that month.